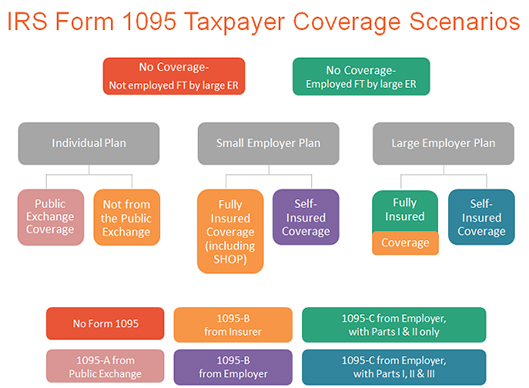

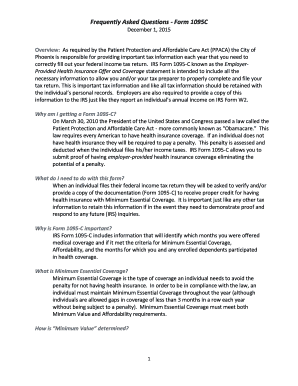

The 1094C must be filed with the Form 1095C, but it acts as a sort of cover sheet that sums up all the 1095Cs As stated above, the primary goal for the IRS with these forms is to determine whether you have satisfied the Employer Mandate, whereby you offer sufficient insurance If you don't satisfy the Employer Mandate, there are finesThe company information will be filled in automatically on form 1094 based on company setup You need to enter other information on Form 1094 manually(ie total number of 1095 forms) Related links How to prepare and print Form 1095C and 1094C How to prepare and print Form 1095B and 1094B How to Import DataThe Form 1095C contains important information about the healthcare coverage offered or provided to you by your employer Information from the form may be referenced when filing your tax return and/or to help determine your eligibility for a premium tax credit

Sample Print Of 1095 B And 1095 C 1095 Software

1095 c completed sample form

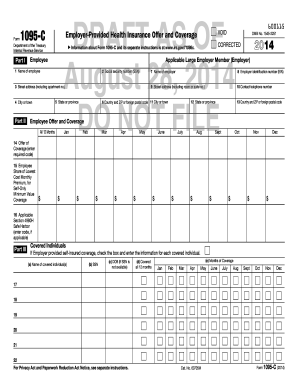

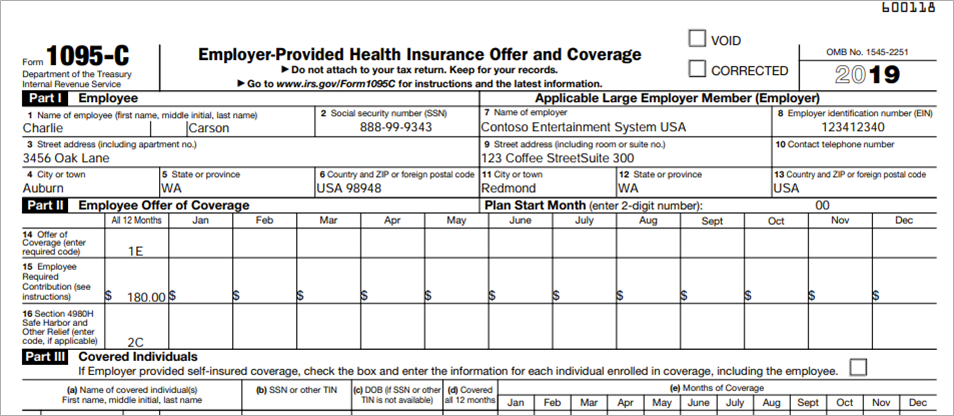

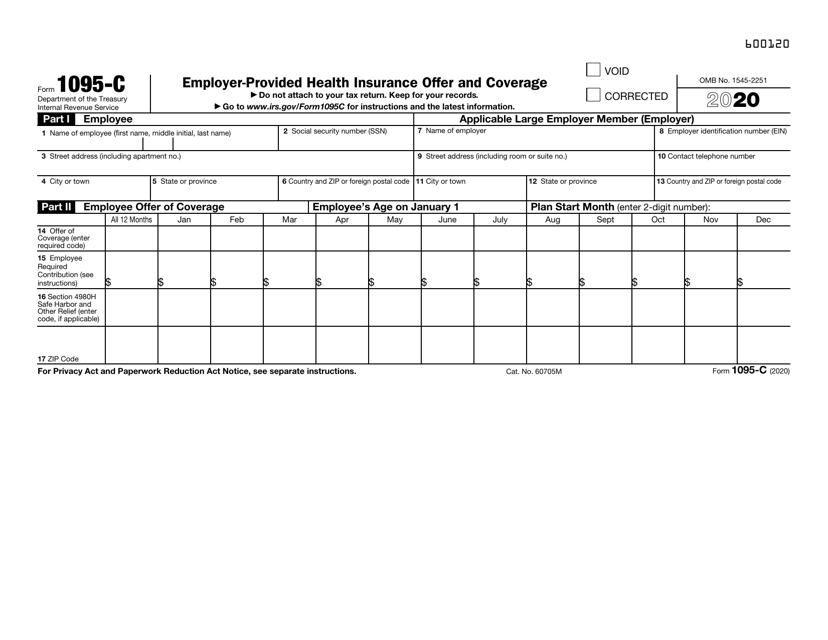

1095 c completed sample form-How to complete Form 1095C In order to stay compliant with the Affordable Care Act in 16, companies with a fulltime staff of 50 or more will need to file a Form 1095C for each employee We'll help you figure out how it worksForm 1095C is a new form designed by the IRS to collect information about ALEs and the group health coverage, if any, they offer to their fulltime employees Employers provide Form 1095C (employee statement) to employees and file copies, along with Form 1094C (transmittal form), to the IRS

Control Files And Sample Forms

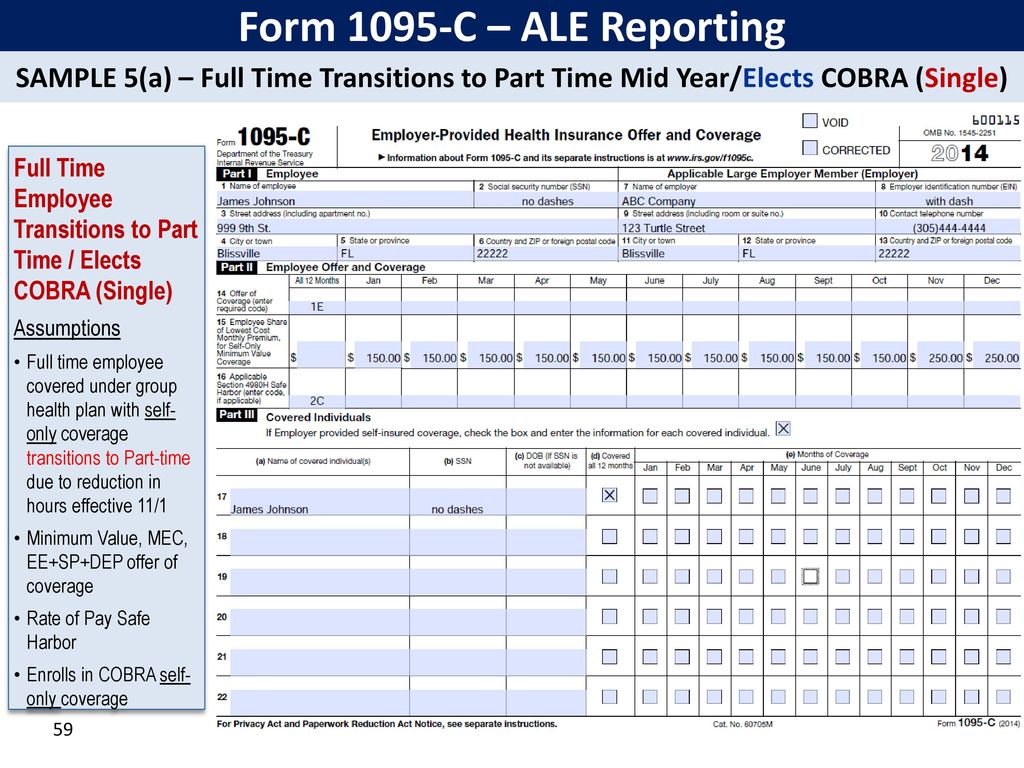

1095c Departmant of Træsl_ry Internal RevenlÆ Service Part I Employee 1 Name of employ— Employee Smith 3 Stræt address apartment ro) 123 Maple Drive Unit 2 EmployerProvided Health Insurance Offer and Coverage Do not attach to your tax retum Keep for your records Information about Form 1095C and its separate instructions is at CORRECTEDA Correct – Part III of form 1095C is only required for plan sponsors and selfinsured ALE members A Waiting periods are considered limited nonassessment periods for ACA purposes, and would be coded as such in your IRS reporting Common 1095C Coverage Scenarios 1 FullTime Employee Enrolled All 12 Months, qualifying offer In this example, the employee (EE) was enrolled in a plan that provided Minimum Essential Coverage (MEC) at Minimum Value (MV) This plan was offered to the EE, the spouse and dependents

Sample 1095C Forms The documents below are meant to be examples of what you should expect to see for some of the most common employee situations Each employee situation is different, so you may have employees whose 1095C forms do not match any of the example below2 3 On the Self Service page, select the Benefits option on the left side, second row 4 On the Benefits page, select 1095C Consent 5 Read the language below regarding consent to electronically receive the 1095C If you agree, select the checkbox in front of "I consent to electronically receive Form 1095C" and select SubmitJohn Barlament walks through how to fill out IRS forms 1094C and 1095C This presentation was given to selffunded employers at an Alliance Learning Circle

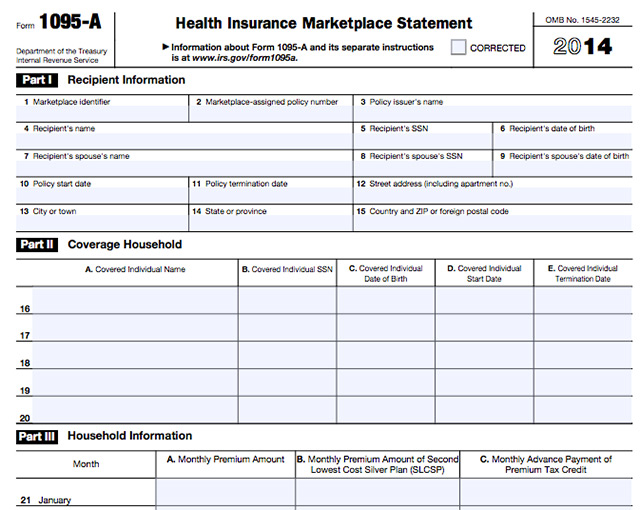

Form 1095C merely describes what coverage was made available to an employee A separate form, the 1095B, provides details about an employee's actual insurance coverage, including who in the worker's family was coveredThis form is sent out by the insurance provider rather than the employerThe Form 1095C includes information about the health insurance coverage offered to you and, if applicable, your family You may receive multiple Forms 1095C if you worked for multiple applicable large employers in the previous calendar year You may need to submit information from the form (s) as a part of your personal tax filing When populating Form 1095C, employers are communicating a lot of information through a series of codes on Lines 14 and 16 It is incredibly important for an employer to have documentation supporting the codes they are using when populating the Forms 1095C Below is a general breakdown of the different codes that could be entered on Lines 14

Employers With 50 99 Ftes Cy15 Aca Returns A Must For Irs Integrity Data

Vehi Org Client Media Files Ale Webinar Presentation Part Ii Examples10 3 18 Pdf

Form 1095C Department of the Treasury Internal Revenue Service EmployerProvided Health Insurance Offer and Coverage Information about Form 1095C and its separate instructions is at wwwirsgov/form1095c OMB No 15 Part I Employee 1 Name of employee 2 Social security number (SSN) 3 Street address (including apartment no) 4 City or town 5Form 1095C Decoder If you were a fulltime employee working 30 or more hours per week or enrolled in healthcare coverage from your employer at any point in , you should receive a Form 1095C If you received a Form 1095C from your employer and you're not sure what the codes mean, check out our 1095C Decoder to learn more Self‐insured employers must report offers of COBRA coverage Employers complete Form 1095‐C providing COBRA coverage information (enrollment in COBRA coverage) How the Form 1095‐C is completed will depend, in part, on whether the employee was covered as an active employee during 18

Ez1095 Software How To Print Form 1095 C And 1094 C

/ScreenShot2021-02-08at3.59.40PM-9f028cea3cb545d19e4c64e10ca68a06.png)

Form 62 Premium Tax Credit Definition

B1 Understanding the Sources for Forms 1095C and 1094C and1095C XML The Form 1095C print and the 1094C or 1095C XML files are handled through the JD Edwards Electronic Document Delivery (EDD) system The system uses the data item aliases during the spool file batch export step to create XML source files, which are then used to map the information toThe 1095C template spreadsheet exports from Accounting CS populated with basic employee information that is formatted to match the Sample 1095C template available in the 1095C spreadsheet import dialog For more information about this process, see Creating a 1095C template spreadsheet Entering information in the spreadsheet 1095B/1095C ACA Filing "Print, Mail, & eFile" & "eDelivery/Print/eFile" orders must be completed by 3/2/21 at 7am (PDT) "eFile Only" orders must be completed by 12pm (Noon, PDT) on The IRS has officially provided notice that the deadline for furnishing (printing & mailing) IRS forms 1095B & 1095C is now extended to March 2nd

Affordable Care Act 1 Properly Reporting Cobra Continuation Coverage Integrity Data

Understanding Form 1095 C And What To Do About Errors The Aca Times

Q Is it correct that Part III on the 1095C form is only for self insured applicable large employers?Sample Form 1095C ACA 1094/1095 Reporting Requirements for 6 Guidance for Applicable Large Employers NOTE This guidance applies to Applicable Large Employers (ALEs) as defined in the ACA regulations and covers the ACA Shared Responsibility (aka, ACA "Pay or Play") Penalties This notice is not a substitute for A Sample 1095 C Form is a request to the IRS asking for payment of tax debts A Form 1095 is not a request for an exemption, but instead is a request to the IRS to pay the appropriate amount of tax owed to the Internal Revenue Service In this article, we will discuss what a Sample 1095 C Form and what it is used for

Control Files And Sample Forms

Understanding Your 1095 C Documents Aca Track Support

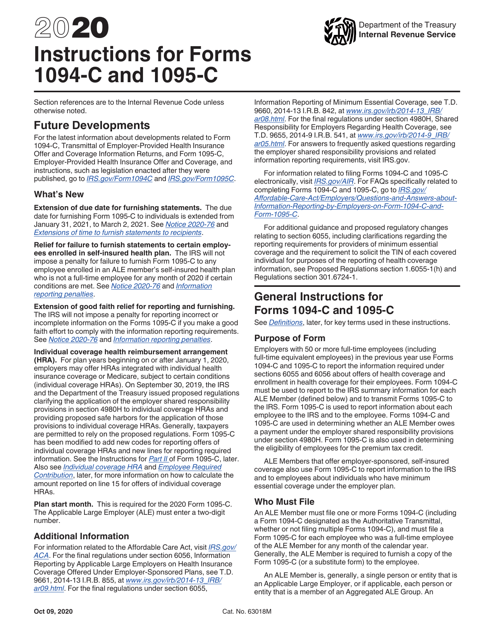

Inst 1094C and 1095C Instructions for Forms 1094C and 1095C 16 Inst 1094C and 1095C Instructions for Forms 1094C and 1095C 15 Inst 1094C and 1095C Instructions for Forms 1094C and 1095C 14 Form 1095C EmployerProvided Health Insurance Offer and Coverage Form 1095CForm 1095A, B or C with your individual federal income tax return to prove compliance with the individual mandate Q4 When should I receive a Form 1095C?Information about Form 1095C, EmployerProvided Health Insurance Offer and Coverage, including recent updates, related forms, and instructions on how to file Form 1095C is used by applicable large employers (as defined in section 4980H(c)(2)) to verify employersponsored health coverage and to administer the shared employer responsibility provisions of section 4980H

Sample 1095 C Forms Aca Track Support

Irs 1095 C Form Pdffiller

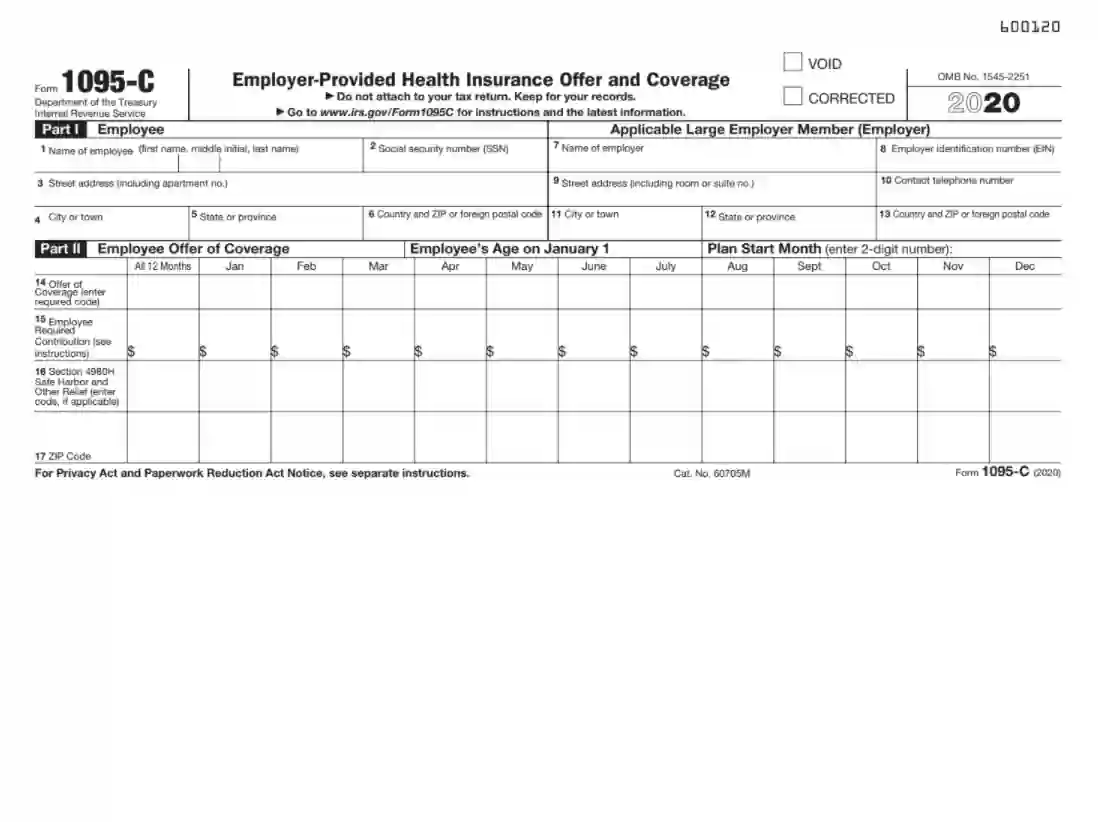

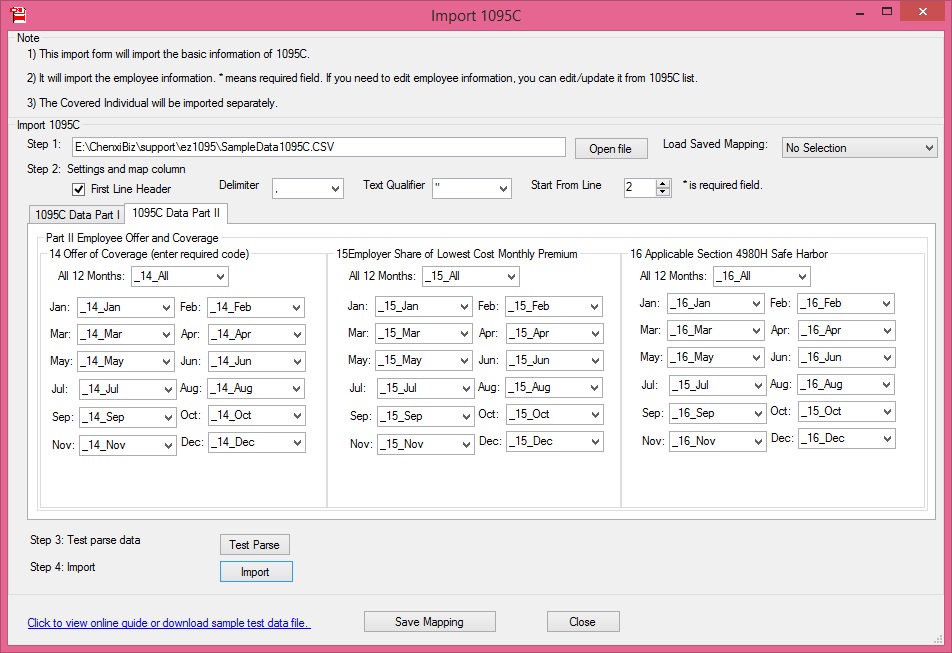

//wwwhalfpricesoftcom/aca1095/aca_sample_files_1095Czip 22 After you unzip the file, you will see two sample data files in the folder Step 3 Clear Form List (Optional) You can click ez1095 top menu "Current Company" then "Form 1095C" to view 1095C list If you have test data in the list, please remove it Step 4 Import 1095C Data Sample IRS Form 1095B NC Medicaid NC Department of Health and Human Services 01 Mail Service Center Raleigh, NCForm 1095C is divided into three parts Part I is used to identify the employee, and the reporting ALE entity It includes demographic information such as name, contact and demographic information, Social Security Number (SSN) and Employer Identification Number (EIN)

Form 1095 A 1095 B 1095 C And Instructions

Guide To Prepare Irs Aca Form 1094 C Form 1094 C Step By Step Instructions

Form 1095C (21) Page 2 Instructions for Recipient You are receiving this Form 1095C because your employer is an Applicable Large Employer subject to the employer shared responsibility provisions in the Affordable Care Act This Form 1095C includes information about the health insurance coverage offered to you by your employer Form 1095C, Part form 1095a sample, form 1095b sample, form 1095c sample, sample completed form 1095a form 1095a sample You can not receive all 3 forms As a customer, you do not need to produce this form because you are made by an insurance company Those interested in Obamacare prizes will end up being a huge problem for tax payers You may notACA Form 1095C Codes Sheet An Overview Updated 800 AM by Admin, ACAwise The IRS requires ALEs to report their employee's health coverage information on Form 1095C To report the information, ALEs must be clear about the Offer of Coverage and Safe Harbor Codes that should be entered on the ACA Form 1095C

Ez1095 Aca Form Software How To Import 1095 C Data From Spreadsheet

Aca Code 1a Alert Irs Clarifies 1095 C Guidance For A Qualifying Offer Integrity Data

Form 1095C is a new IRS tax form that you received because your employer is subject to the employer shared responsibility provision in the Affordable Care Act A sample form is available on the IRS website Form 1094C and Form 1095C (and related instructions) will be used by ALEs (eg employer with 50 or more fulltime employees including fulltime equivalents) that are reporting under Section 6056, and for combined reporting by ALEs that sponsor selfinsured plans required to report under both Sections 6055 and 6056HR360's sample letters include Explanations of why the employee is receiving Form 1095C Information included in the Form 1095C (including an explanation of Part III for selfinsured plans) Descriptions of why an employee may receive multiple Forms 1095C As a special bonus, we have also included a sample employee letter for use by small selfinsuring employers—generally those with fewer than 50 fulltime employees (including fulltime equivalent employees)—regarding Form 1095B

Sample 1095 C Forms Aca Track Support

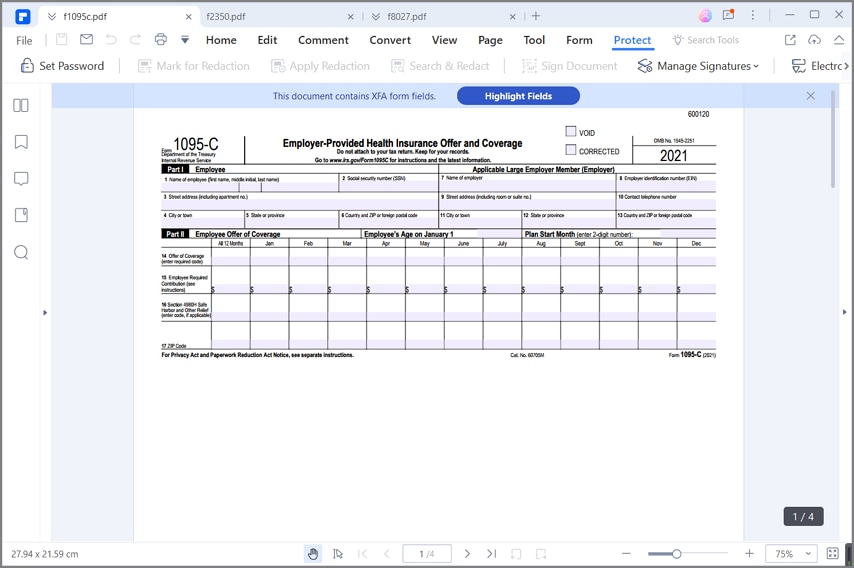

Updates To Form 1095 C For Filing In 21 Youtube

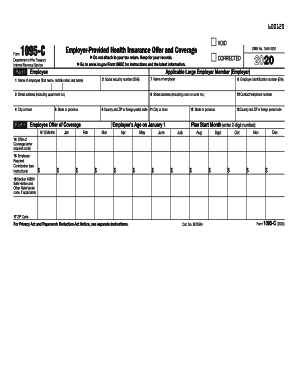

Employers Should Be Preparing Now for Form 1095C Reporting By , applicable large employers will be required to send Forms 1095C to verify certain information about the employer's 15 health coverage Form 1095C will be used by the IRS to verify an individual's compliance with the Affordable Care Act individual mandate Sample Excel Import File 1095C xlsx In Part 2, added field "Employee's Age on January 1" before the Plan Start Month field New codes for line 14 "Offer of Coverage" 1L, 1M, 1N, 1O, 1P, 1Q, 1R, 1S New field, line 17 "Zip code"Reference Guide for Part II of Form 1095C Lines 14, 15, and 16 (revised for the final 17 forms) November 17 • Lockton Companies L O CKT O N CO M P ANIES GLOSSARY Children means an employee's biological and adopted children (including children placed with the employee for adoption), from birth, adoption, or placement through the end of the month in which the child

Control Files And Sample Forms

260 W 2 And 1099 Software Ideas In 21 Irs Irs Forms Efile

What is Form 1095C?Form 1095C is a reference document that is not completed by the taxpayer It is not filed with a tax return Instead, it should be kept with the taxpayer's records Part I of the form providesWithin a submission every Form 1095C requires a RecordId RecordId should start at 1 and increment by 1 sequentially for each Form 1095C in the submission

Download Instructions For Irs Form 1094 C 1095 C Pdf Templateroller

Can An Employee Decline Health Insurance Gusto

Sample Output 1094B/1095B and 1094C/1095C Upload Specifications Files must be created using a piped delimited text (txt) file format XML, Zip or compressed files will NOT be accepted Files 250MB or larger must be submitted as multiple submissions Files that are 250MB orClick the top menu "Current Company" then the sub menu "Form 1094C" to view 1094C screen Note ez1095 software can print both 1095C and 1094 C forms for IRS and recipients on white paper No preprinted form is needed IRS changed form format in Year The Form has 2 pages Year 1519 form has only one page;Sample 1095 C form

Updated Hr S Guide To Filing And Distributing 1095 Cs Bernieportal

1095 C 1094 C Aca Software To Create Print E File Irs Form 1095 C

•IRS Form 1095C has a VOID checkbox (Not found on Form 1094C) •There is no reference to how to use this in the IRS instructions •Until further guidance is provided, if you want to "void" a previously transmitted 1095C, you should submit a "Corrected" form with Part II stating the employee was ineligible for all 12 monthsYou are receiving this Form 1095C because your employer is an Applicable Large Employer subject to the employer shared responsibility provisions in the Affordable Care Act This Form 1095C includes information about the health insurance coverage offered to you by your employer Form 1095C, Part The follow guide provides an insight on how you can complete the IRS form 1095C using the PDFelement program Step 1 Go to the Internal Revenue Service Website and download a copy of the IRS Form 1095C with the filling instructions Open it with PDFelement and start filling it out using the program Step 2 Begin filling Part IEmployee

Consulting Americanfidelity Com Media 1439 18 01 17 17 Instruction Guide Step 3 Pdf

Irs Affordable Care Act Reporting Forms 1094 Ppt Download

A PDF of Form 1095B is here Try downloading and printing The offsets for the mailing addresses can be adjusted to get them to line up perfectly for almost any envelope Below is a screen shot of Form 1095C and to the right are the instructions with mailing addresses A PDF of Form 1095C is here Download and try printing The IRS released for comments a draft of Form 1095C Employers will use the final version early next year to report on health coverage in The revisions add a second page to the form and mayA Employers are required to distribute Forms 1095C by The form provides information relating to

Accurate 1095 C Forms A Primer Erp Software Blog

Affordable Care Act Aca Ability To Generate 1095 B And 1095 C Forms Microsoft Dynamics Ax Community

Form 1095 A 1095 B 1095 C And Instructions

Ez1095 Software How To Print Form 1095 C And 1094 C

Ez1095 Software How To Print Form 1095 C And 1094 C

Annual Health Care Coverage Statements

1095 C Template Fill Online Printable Fillable Blank Pdffiller

Q Tbn And9gcsj2fd0y5g6r8mt9bhze7eiq3dikiuy6ur5pdhj7m9zdqnm8y O Usqp Cau

Sample Print Of 1095 B And 1095 C 1095 Software

1095 C Printing Microsoft Dynamics Gp Forum Community Forum

1

Form 1095 C Forms Human Resources Vanderbilt University

1

Www Jibei Org Media 1413 Aca Alert Irs Form 1095 C Information For Phbp Contributing Employers Pdf

Form 1095 A 1095 B 1095 C And Instructions

Updated Sample Employee Letters For Irs Forms 1095 B And 1095 C Kistler Tiffany Benefits

Irs Form 1095 C Fill Out Printable Pdf Forms Online

Benefitscape Com Portals 1 Xblog Uploads 16 10 27 Sample letter requesting extension for distributing forms 1095 Pdf

/ScreenShot2021-02-11at12.24.19PM-2c611375f2b44f57b6181bc158b48119.png)

About Form 1095 A Health Insurance Marketplace Statement Definition

Irs Affordable Care Act Reporting Forms 1094 Ppt Download

1094 C 1095 C Software 599 1095 C Software

Irs Drafts Of New 16 Forms 1095 C 1094 C Leavitt Group News Publications

Sample Print Of 1095 B And 1095 C 1095 Software

Ez1095 Software Speeds Up 1095 C Filing With Quick Data Uploading Feature Newswire

Irs Health Coverage Reporting Form 1095 C Examples For Youtube

Form 1095 C Guide For Employees Contact Us

1

Sample 1095 C Forms Aca Track Support

What Payroll Information Prints On Form 1095 C To Employees

Vehi Org Client Media Files Ale Webinar Presentation Part Ii Examples10 3 18 Pdf

Common 1095 C Coverage Scenarios With Examples Boomtax

Tax Forms Bfi Printing Mailing Services Inc

1095 Express Software 1099 Express

Free 1095 C Resource Employee Faqs Yarber Creative

1095 C Template Fill Online Printable Fillable Blank Pdffiller

Sample 1095 C Forms Aca Track Support

1094 C 1095 C Software 599 1095 C Software

:max_bytes(150000):strip_icc()/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png)

Form 1095 C Employer Provided Health Insurance Offer And Coverage Definition

Irs Affordable Care Act Reporting Forms 1094 Ppt Download

File Taxes For Obamacare

Ez1095 Aca Form Software How To Import 1095 C Data From Spreadsheet

What Is The Irs 1095 C Form Miami University

Affordable Care Act 1 Properly Reporting Cobra Continuation Coverage Integrity Data

Locating Transmission Information For Corrected Form 1094 C And 1095 C Internet Files

Www Ftb Ca Gov File Business Report Mec Info Ftb File Exchange System 1094 1095 Technical Specifications Part 1 Pdf

1094 B 1095 B Software 599 1095 B Software

1095 C Print Mail s

Vehi Org Client Media Files Ale Webinar Presentation Part Ii Examples10 3 18 Pdf

Generate Affordable Care Act Reports In Benefits Management Human Resources Dynamics 365 Microsoft Docs

How Can I Get My Health Insurance Tax Form

Mbwl Aca Prime Employer S Guide To Aca Reporting 1 9 17

Common 1095 C Coverage Scenarios With Examples Boomtax

Guide To Prepare Irs Aca Form 1094 C Form 1094 C Step By Step Instructions

Irs Form 1095 C The Best Way To Fill It Out Wondershare Pdfelement

Irs 1095 C Form Pdffiller

Vehi Org Client Media Files Ale Webinar Presentation Part Ii Examples10 3 18 Pdf

Form Irs 1095 C Fill Online Printable Fillable Blank Pdffiller

Ez1095 Software How To Print Form 1095 C And 1094 C

Irs Form 1095 C Fauquier County Va

Control Tables And Sample Forms

Yearli Form 1095 C

Changes Coming For 1095 C Form Tango Health Tango Health

Http Www Fleming Kyschools Us Userfiles 4 My files Finance 1095c letter to employees Pdf Id

Think 14 Tax Forms Are Bad Here Come The 1094 And 1095 For 15 Clemons Company Clemons Company

What Is The Irs 1095 C Form Miami University

1095 C Sample Hcm 401 K Human Resources

Www Kff Org Wp Content Uploads Sites 3 15 02 Sample 1095 A Pdf

Irs Form 1095 C Codes Explained Integrity Data

Vehi Org Client Media Files 19 Small Sds Sus Reporting Information Guide 1094 95 B Forms Finalv3 Pdf

Aca Reporting Penalties Newfront Insurance And Financial Services

Vehi Org Client Media Files Ale Webinar Presentation Part Ii Examples10 3 18 Pdf

Irs Form 1095 C Download Fillable Pdf Or Fill Online Employer Provided Health Insurance Offer And Coverage Templateroller

2

Sample 1095 C Forms Aca Track Support

Vehi Org Client Media Files Ale Webinar Presentation Part Ii Examples10 3 18 Pdf

Www Irs Gov Pub Irs Prior F1095c 15 Pdf

Employment Law Update May 27

Sample 1095 C Forms Aca Track Support

Ez1095 Aca Form Software How To Import 1095 C Data From Spreadsheet

Fillable Online Employee Phoenix Sample 1095 C Form Employee Phoenix Fax Email Print Pdffiller

0 件のコメント:

コメントを投稿